Some Known Questions About Personal Loans copyright.

Table of Contents8 Easy Facts About Personal Loans copyright Described4 Easy Facts About Personal Loans copyright ExplainedAll about Personal Loans copyrightMore About Personal Loans copyrightThe smart Trick of Personal Loans copyright That Nobody is Talking About

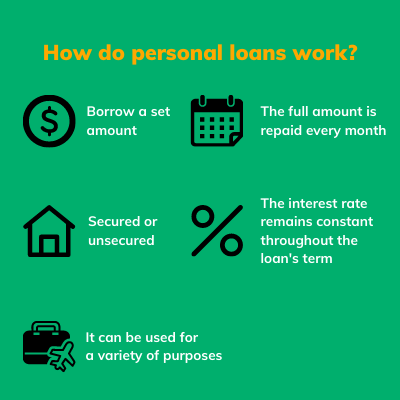

Settlement terms at many individual financing lending institutions vary in between one and seven years. You get every one of the funds at the same time and can utilize them for nearly any objective. Debtors frequently use them to fund an asset, such as an automobile or a watercraft, pay off financial debt or aid cover the cost of a major expense, like a wedding or a home restoration.

Individual finances included a fixed principal and interest month-to-month settlement for the life of the car loan, determined by building up the principal and the rate of interest. A set rate offers you the safety and security of a predictable month-to-month settlement, making it a popular option for settling variable rate charge card. Repayment timelines differ for personal lendings, however customers are usually able to select settlement terms in between one and 7 years.

Personal Loans copyright for Dummies

The fee is typically subtracted from your funds when you complete your application, reducing the quantity of money you pocket. Personal finances rates are a lot more directly linked to brief term rates like the prime rate.

You might be offered a lower APR for a much shorter term, due to the fact that lenders recognize your balance will be repaid faster. They may bill a higher price for longer terms recognizing the longer you have a car loan, the more probable something might alter in your financial resources that could make the payment expensive.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

An individual lending is likewise an excellent option to utilizing charge card, considering that you borrow money at a fixed rate with a definite benefit date based on the term you choose. Bear in mind: When the honeymoon is over, the month-to-month payments will be a reminder of the cash you spent.

The 5-Second Trick For Personal Loans copyright

Contrast passion prices, charges and lending institution track record prior to applying for the car loan. Your credit history rating is a huge aspect in identifying your eligibility for the lending as well as the rate of interest rate.

Before using, understand what your rating is so that you know what to anticipate in regards to costs. Be on the search for concealed charges and fines by checking out the loan provider's terms and conditions page so you don't wind up with less cash money than you need for your financial objectives.

They're much easier to qualify for than home equity financings or various other safe loans, you still require to show the lending institution you have the methods to pay the finance back. Personal fundings are much better than credit history cards if you want a set month-to-month settlement and require all of your funds at once.

Personal Loans copyright - Truths

Charge card might be better if you need the flexibility to attract cash as try this site required, pay check my blog it off and re-use it. Charge card may likewise offer benefits or cash-back alternatives that individual financings don't. Eventually, the very best credit rating item for you will depend upon your money habits and what you require the funds for.

Some lending institutions might likewise charge fees for individual finances. Personal finances are car loans that can cover a variety of personal expenditures. You can discover personal loans via financial institutions, credit score unions, and online lenders. Personal car loans can be protected, implying you need security to obtain money, or unsecured, without any security needed.

, there's generally a fixed end date by which the car loan will be paid off. An individual line of credit scores, on the other hand, might remain open and offered to you indefinitely as lengthy as your account remains in great standing with your loan provider.

The cash received on the loan is not exhausted. Nonetheless, if the lending institution forgives the financing, it is thought about a terminated financial debt, which quantity can be tired. Personal fundings might be protected or unsafe. A protected personal loan calls for some type of collateral as a problem of borrowing. You might protect an individual finance with money properties, such as a cost savings account or certification of deposit (CD), or with a physical property, such as your cars and truck or boat.

All About Personal Loans copyright

An check my reference unprotected individual loan calls for no collateral to obtain money. Banks, cooperative credit union, and online loan providers can offer both safeguarded and unprotected individual fundings to qualified debtors. Banks typically think about the latter to be riskier than the former because there's no collateral to accumulate. That can suggest paying a greater rates of interest for an individual funding.

Again, this can be a bank, debt union, or on-line individual lending lender. If approved, you'll be provided the finance terms, which you can approve or turn down.

Comments on “Not known Details About Personal Loans copyright”